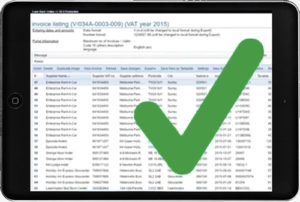

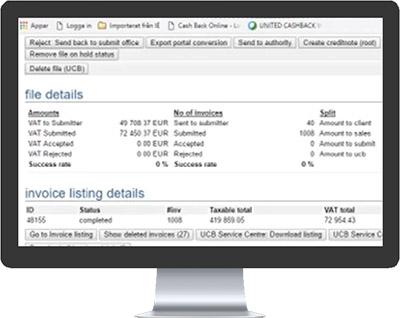

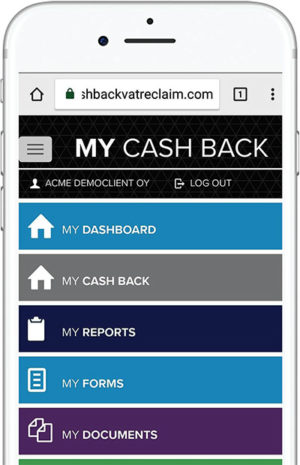

From data retrieval to payment processing and reporting our systems automate every step in the foreign VAT recovery process to ensure maximum refunds in the quickest time.

The difference with our automated systems is their integration with quality assurance checks by local VAT experts, providing simplification and accuracy in the multi-dimensional complexity of VAT claims to tax portals or tax authorities in more than 30 countries.

30 years of experience and learning has been built into our tools to ensure efficiency, transparency and compliance.